Fintech Funding in India and SEA drop ~65% in 2023 | TWIF 16-12-2023

Hi fintech friends, I'm Osborne, Principal at EMVC!

Please enjoy all the news and updates from the past week in today’s edition. If you feel TWIF brings you value, please share it with your friends (and maybe suggest they subscribe too).

🧐🏆 Posts of the Week

Heard this in a bank meeting:

— Pete (@PeteJaison) December 11, 2023

Mumbai banker: You Bangalore people don't know anything about finance. You understand a bit of tech and then, call it fintech. We've been doing this for 10 years and we still call it banking

The room for someone to build a mass consumer travel card or BNPL experience is still untapped pic.twitter.com/Jtzs05vaBS

— Simon Taylor (@sytaylor) December 15, 2023

It took 11 months and 181 investor meetings to raise @Vimcal's last round

— John Li (@jaylbird11) December 14, 2023

Fundraising at the bottom of the market... really sucked

Here are 5 crucial things to know if you're raising in 2024:

Have you ever heard of bounce charges?

— Mehul Nath Jindal (@mehuljindal18) December 12, 2023

Whenever the auto-debit for your EMI fails due to low balance (say your salary is late or you forgot to transfer the money).

This will cause the Savings Bank to charge you upto 500+GST as penalty. #AccountAggregator

(Note: Neither TWIF nor I endorse any views in the tweets highlighted above.)

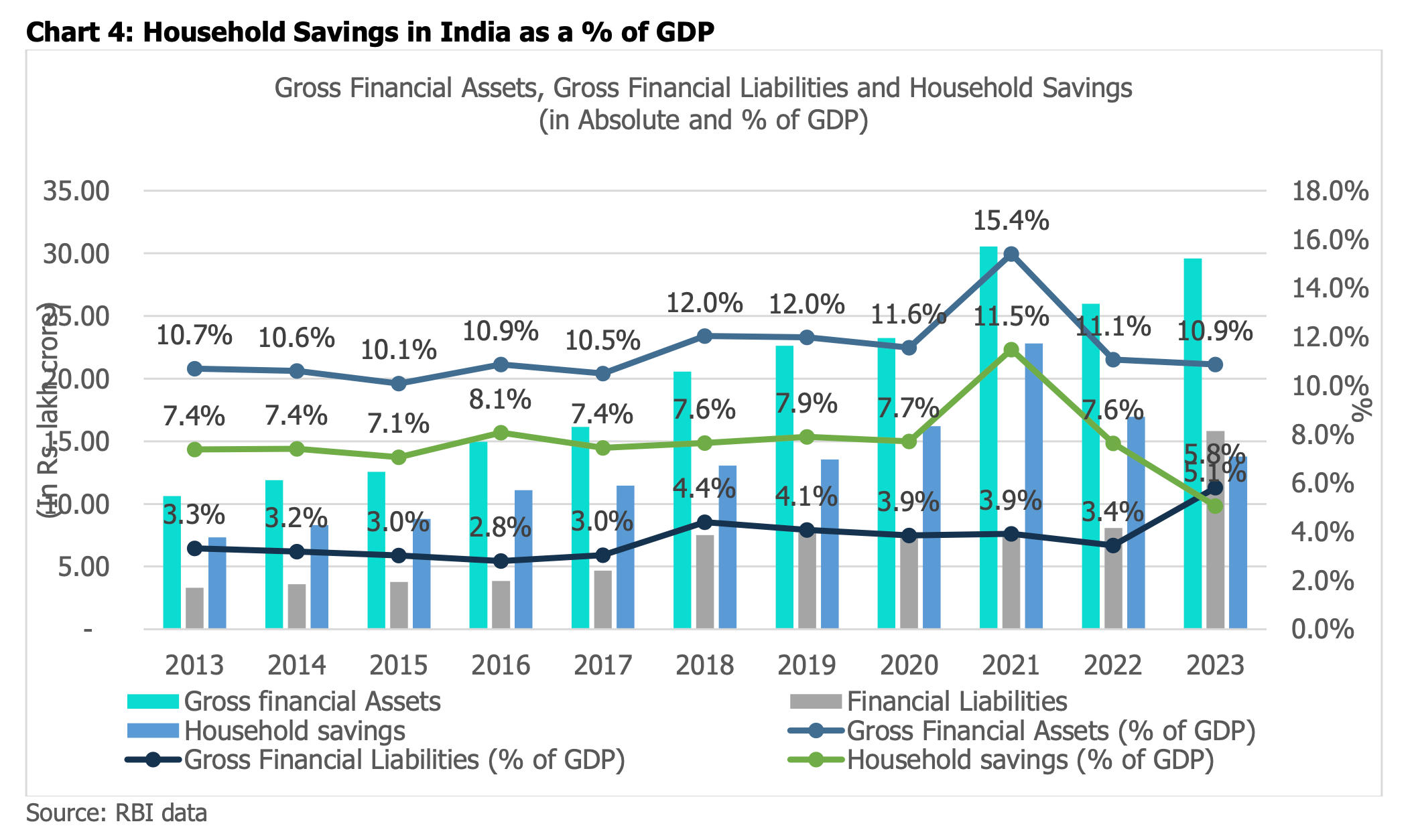

📈 Chart of the Week

Source: Care Ratings

🇮🇳 India

📰 Market Updates

- RBI reportedly initiated discussions with the central banks of Hong Kong US and others to explore the use of CBDC's for cross border payments.

- Digital lender members of Fintech Association for Consumer Empowerment (FACE) reported a 39% YoY increase in loans disbursed for the quarter ended Sept, 2023. The members disbursed INR 31.7K crs ($3.9bn) in loans during the same quarter.

- Tech startups in India raised $7bn in 2023 (-72% YoY), the lowest amount in five years. Fintech startups raised a cumulative $2.1bn in funding in 2023 (-65.6% YoY).

- Niyo, a neo banking startup, reported $16mm in revenue in FY23 (+2.8x YoY).

- PhonePe reported hitting $ 1trillion in annualised total payment value (TPV) and cornering 50% of the UPI paments market.

- Paytm is investing INR 100cr ($12mm) in India's GIFT City to set up a global payment center.

- Pradhan Mantri Jan Dhan Yojana (PMJDY), a government scheme to open bank accounts for all, opened 510mm bank accounts, with total deposits exceeding INR 2tn ($24bn).

- Shriram Finance is planning to launch Shriram One, a financial super app, in January, 2024, offering 150-200 products.

- Bain reportedly sold $448mm of its stake in Axis Bank.

- Juspay is planning to launch a full stack payment gateway and is expected to expand operations to US.

- Mutual fund AuM crossed INR 50tn ($600bn) in Dec 2023.

🚀 Product Launches

- Infibeam Avenues, a payments company, launched a capital markets product.

📝 Regulatory Updates

- RBI (central bank): Admitted an HDFC and Crunchfish, a Swedish CBDC payments company, offline payments product in the "Test Phase" of the RBI Retail Payments Regulatory Cohort.

💰 Financing Announcements

- Aye Finance, a micro lending startup, raised $37mm.

ACQUISITIONS:

- M2P Fintech*, a banking SaaS startup, acquired Goals101, a transaction behaviour intelligence startup for $30mm.

- Mirae Asset, an asset management company, acquired 72.76% of Sharekhan, a retail stock brokerage firm.

- Infibeam Avenues, a payments company, acquired 49% shareholding in Pirimid Fintech, a capital markets SaaS company.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 Asia

📰 Market Updates

- Fintech funding in SEA in 2023 stood at $2bn, 65% lower from the previous year.

- Swift invited participants to compete in its "Innovation Challenges" to create AI-based solutions aimed at cross border payments.

- DCS Card Center, previously Diners Club Singapore, raised SGD 300mm in issuance of asset-backed finance notes.

- Julo, a P2P lending startup, launched Julo Cares, an embedded insurance cover with Julo Credit.

💰 Financing Announcements

- Validus, a Southeast Asian SME financing startup, raised $20mm.

- Pave Bank, a Singapore based digital bank for Georgia, raised $5.2mm.

🌏 International

• Join other execs from Visa, Plaid, Stripe, Robinhood, Revolut, Chime, Rapyd, and more to get the latest insights and deep dives.

• Learn from and collaborate with the world's largest fintech community, with 75,000+ members.

• Memberships start at $10 per month.

👉 Join today.

If you’ve made it this far - thanks! As always, you can always reach me at osborne@thisweekinfintech.com. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Comments ()