Fintech M&A activity on the rise | TWIF - 23rd Mar, 2025

Hi fintech friends, I'm Osborne, investor in early stage startups.

Please enjoy all the news and updates from the past week in today’s edition. If you feel TWIF brings you value, please share it with your friends (and maybe suggest they subscribe too).

Help us deliver more value! Please take 2 minutes to complete this quick survey about your fintech interests and preferences. Your feedback will directly shape our newsletter content and upcoming events to better serve professionals like you across Asia's dynamic fintech landscape.

Are you considering starting up? I’d love to help. DM me here: superdm.me/osborne

🧐🏆 Posts of the Week

How banks' cost of funds rising:

— Tamal Bandyopadhyay (@TamalBandyo) March 19, 2025

In FY25, issuances of CDs up 34% to all-time high of ₹10.58 trillion (up to March 7. CP issuances at ₹13.90 trillion up to Feb 28, 13.5% higher.

What more. Share of deposits bearing 7% or more interest 70.8% of term term deposits in Dec 2024,…

The reality is that UPI growth has now slowed to just 20-25%.

— Amrish Rau (@amrishrau) March 21, 2025

Digital payments hasn’t been fully taped. Base number isn’t large and this growth is low. Investment in UPI deployments for small markets have dried up.

UPI needs to become a business, to fund its own growth. https://t.co/od5hK2CLZO

I worry a lot about founders who don't have a CFO with a black ThinkPad with a little red nipple in the middle of the keyboard

— Eoghan McCabe (@eoghan) March 19, 2025

Breakdown in our machine. Engineers found faulty cable. Found it online at US warehouse for $107. Purchase guy paid with CC, cable arrived in 4 days, problem fixed! But now bank says import remains ‘unpaid’ because payment not routed through a formal channel. They’re marking us…

— Sandeep Mall (@SandeepMall) March 17, 2025

(Note: Neither TWIF nor I endorse any views in the tweets highlighted above.)

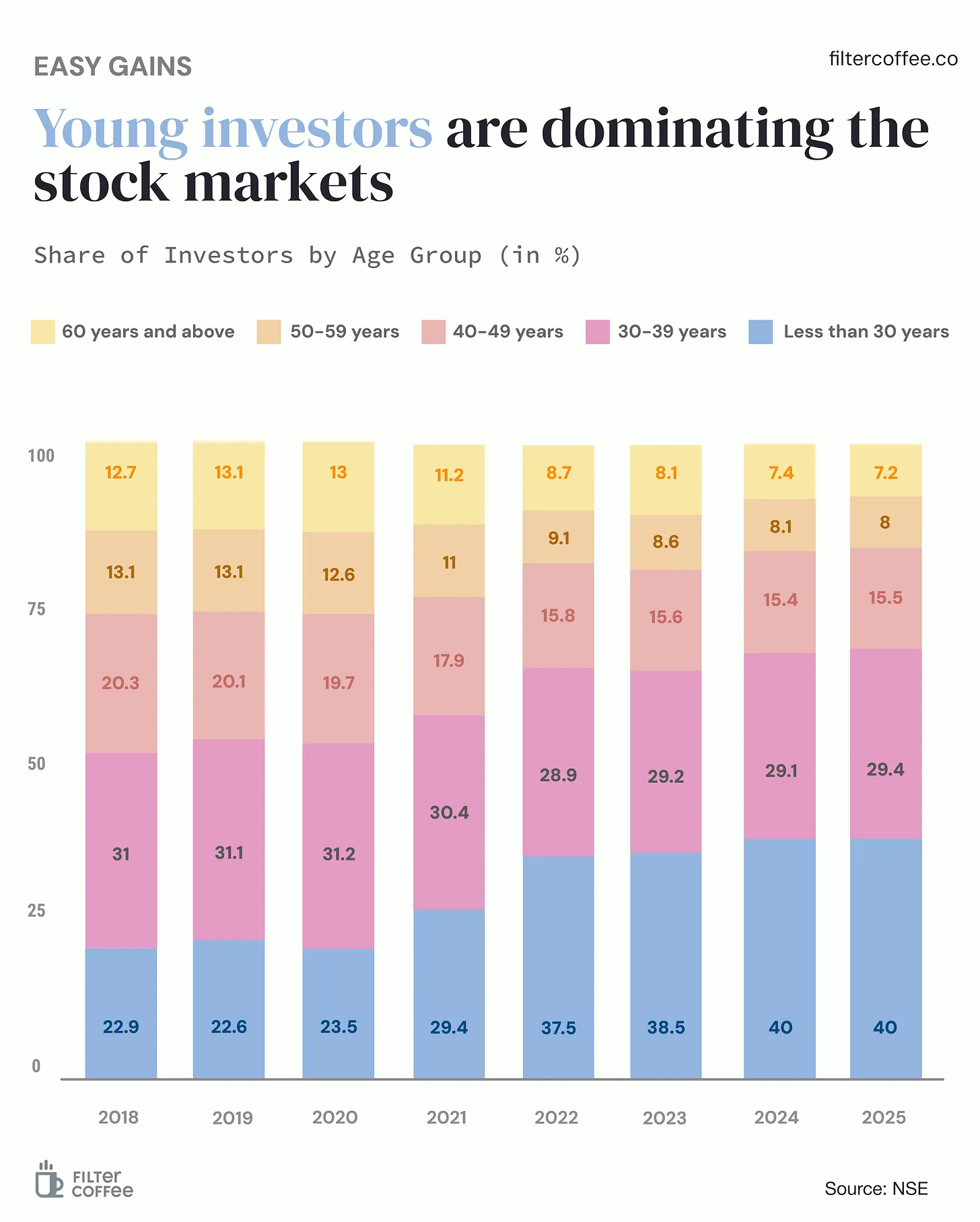

📈 Chart of the Week

🇮🇳 India

📰 Market Updates

- The Indian Union Cabinet approved an incentive scheme of INR 1,500cr ($174M) to promote low-value (<INR 2K) BHIM-UPI transactions (P2M) for small merchants.

- National Payments Corporation of India (NPCI), the umbrella entity managing UPI (Unified Payments Interface), is considering phasing out the 'Collect Payments on UPI' feature to curb online fraud and protect customers.

- PwC reported the credit card market in India is expected to double to INR 2 lakh crores ($23.3Bn) by 2028-29.

- Account Aggregator consents have grown 79% to 280K per day, driven mainly by digital lenders.

- Account Aggregator, a financial data sharing platform, disbursed INR 74,500 crore ($8.6B) in H1 FY25 (ending Sep-24), according to a report by Sahamati.

- IndusInd Bank, an Indian private sector bank, is investigating a INR 2,100cr ($244M) accounting discrepancy that may impact 2.35% of its net worth.

- Barclays infused INR 2,300cr ($ 270M) capital into its Indian operations.

- The Finance Ministry, according to the report, warned that the shift of household savings to market-linked financial products exposes them to significant risks.

- mswipe, a mobile Point-of-Sale (PoS) payments startup, partnered with Cashflows to launch its offerings in the UK market, targeting the overseas Indian community.

- QueueBuster, a POS payments startup, expanded operations to the Middle East and North Africa (MENA) region.

- Indian Banks wrote off bad loans worth INR 16.35 lakh crores ($ 193Bn) over the last 10 years according to RBI data.

- Paytm Money, the wealth management arm of Paytm, received approval from Securities and Exchange Board of India (SEBI) to act as a research analyst.

- Public sector banks plan to create a common video Know Your Customer (vKYC) hub to help onboard customers more seamlessly.

🚀 Product Launches

- MyFi, a wealth management startup, launched MyCash, a product offering instant loans of up to INR 10L ($ 12K) against mutual fund investments.

- Vistra, a provider of corporate, trust and fund administration services, launched a global AI-powered compliance advisory solution to automate regulatory compliance.

- Poonawalla Fincorp, an Indian non-banking financial company, launched commercial vehicle (CV) loans business targeting tier 2-3 markets.

📝 Regulatory Updates

- SEBI (securities): Partnered with DigiLocker, the digital document wallet, to provide investors with a single interface for all their financial assets, with the objective to reduce unclaimed financial assets and demat accounts.

💰 Financing Announcements

ACQUISITION:

- Allianz, a German insurer, agreed to sell its 26% stakes in Indian joint ventures Bajaj Allianz Life Insurance and Bajaj Allianz General Insurance, to partners Bajaj Finserv for INR 23,900cr (USD 2.8B).

- PayU, an online payment solutions provider, acquired a 43.5% stake in Mindgate Solutions, a banking and payment technology company, for an undisclosed amount.

- Decimal Technologies, a no-code/AI lending company, acquihired Namaste Credit, a small business finance tech startup.

- Bain Capital, a global private equity firm, acquired a 18% stake in Manappuram Finance, a gold-backed finance company, for INR 4,385cr ($ 510M).

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 Asia

📰 Market Updates

- Dlocal partnered with Temu, a cross-border e-commerce marketplace, to enable localized payments in Africa, Asia and Latin America through a buy-now-pay-later offering.

- DLocal, a LatAm payments company, also partnered with Belmoney, a European remittances company, to facilitate money transfers and payment methods in select Asian and South American countries.

- Validus, Singapore's small and medium enterprise (SME) financing platform, is discontinuing its services in Vietnam.

- Bank Saqu, an Indonesian bank, partnered with Indosat, a telecom operator, to launch mobile banking integration, allowing Indosat users to access Bank Saqu's financial services through Indosat's apps.

- Vietnam's National Assembly amended the Securities Law, introducing key changes for foreign investors in Vietnam's securities markets, effective January 1, 2026.

- Paysa Technologies, a payments startup based in Pakistan, secured in-principle approval from the State Bank of Pakistan (SBP) for an EMI (Electronic Money Institution) license.

- Visa partnered with Vietnam's Ministry of Information and Communications (MISA) to launch mobile payments enablement, facilitating digital payments adoption across Vietnam.

- Standard Chartered Bank in Singapore launched MyWay account which offers up to 3% interest and includes complimentary digital scam protection insurance covering up to S$50,000 against losses from unauthorized electronic transfers due to phishing and malware scams.

- HitPay, a payments solution provider for businesses in Singapore, partnered with NPCI International Payments Limited (NIPL) to integrate India's Unified Payments Interface (UPI) into its platform.

- Hyundai Card partnered with Line Pay, a digital wallet service owned by the Japanese messaging app Line, to launch QR code payment services in Taiwan.

- Bank of Korea (BOK), South Korea's central bank, ruled out accumulating a bitcoin reserve over volatility risks and non-compliance with IMF guidelines, according to a parliamentary review.

- Indonesia Stock Exchange (IDX), the country's stock exchange operator, temporarily halted stock trading on Mar18 after the Composite Stock Price Index declined by 5%.

- Hong Kong witnessed a 250% YoY increase in the number of decentralized applications (DApps) launched since 2022, according to industry reports.

- UnionPay, China's leading bank card provider, partnered with Cambodia and Thailand to launch a cross-border payment service, enabling UnionPay cardholders to make mobile payments in the two countries.

- Alipay, owned by Ant Group, contributes more than 80% of inbound QR payments in Malaysia via DuitNow, a real-time retail payments platform operated by Payments Network Malaysia (PayNet).

- Instapay partnered with Amar Bank in Malaysia to launch financial inclusion services, targeting underbanked segments in rural areas.

- Vilja, a Swedish fintech, expanded into Vietnam following its growth in Malaysia and Thailand.

- Rumah123, an Indonesian property marketplace, partnered with Ringkas, an Indonesian lending startup, to launch property financing products.

💰 Financing Announcements

- RedotPay, a Hong Kong based stable coin payments startup, raised $40M.

- Versa, a Malaysian wealth management startup, raised $6.8M.

- Higala, a Philippine payments startup, raised $2.8M.

- BetterX, a Singaporean B2B digital asset management startup, raised $1.5M.

- Funding Societies, a Southeast Asian small business lending startup, raised an undisclosed amount.

ACQUISITION:

- Mitsubishi UFJ Financial Group (MUFG), a Japanese financial services company, acquired 40% in JACCS, a Japanese consumer credit company.

🌏 Sponsor on TWIF

Mail us at sponsor@thisweekinfintech.com

If you’ve made it this far - thanks! As always, you can always reach me at osborne@thisweekinfintech.com. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Comments ()